Importance of Staying Invested

It's common for investors to feel the urge to react to market fluctuations by adjusting their portfolios or trying to predict market movements. However, research and historical data consistently show that attempting to time the market can lead to missed opportunities and lower overall returns. Here are a few reasons to consider maintaining a long-term investment strategy:

- Market Timing Challenges: No one can consistently predict market highs and lows. Even seasoned investors can make mistakes trying to time their entries and exits.

- Growth Over Time: Despite short-term volatility, the market has shown significant growth over extended periods. By staying invested, you can capitalize on this long-term growth trend and benefit from compound interest.

- Reduced Stress: Constantly monitoring and reacting to market changes can be stressful. By focusing on long-term goals and resisting short-term temptations, you can enjoy greater peace of mind and a more stable investment journey.

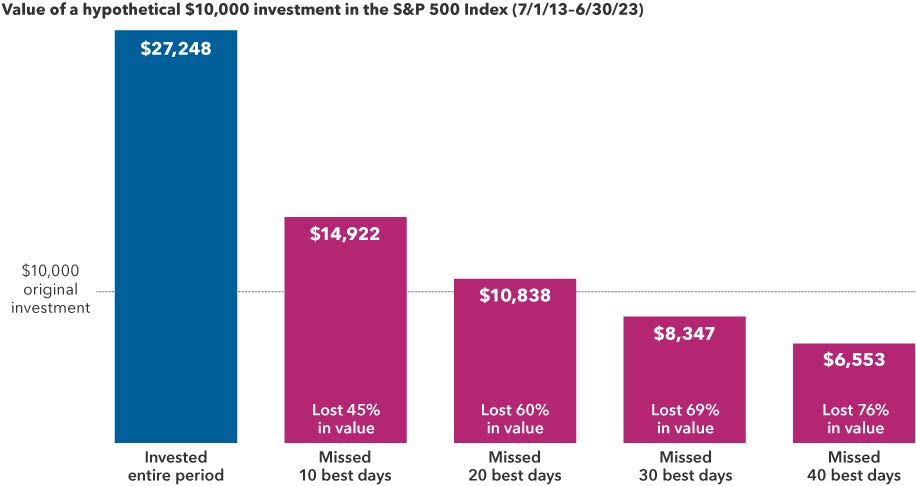

- Cost of Missing Out: Some of the market's biggest gains occur in short, unpredictable bursts. By staying invested, you ensure you don't miss out on these critical growth periods that can significantly impact your overall returns.

In conclusion, while market fluctuations can be unsettling, maintaining a long-term perspective and staying invested is often the most prudent strategy for achieving your financial goals. If you have any questions or need guidance, please don't hesitate to reach out. We are here to help.

Sources: Standard & Poor's, RIMES, as of 06/30/2023. Values in USD. Past performance is not indicative of future results.